Your Guide to Becoming Self Employed

So you’ve got your qualifications and experience, it’s now time to set yourself up in business. We’ve put together this resource to guide you through the process of becoming self employed. Find out the benefits of being a sole trader or a limited company, and the downsides to each of them. Maximise on your skills and choose the right path for you to become your own boss!

Self Employment in the UK

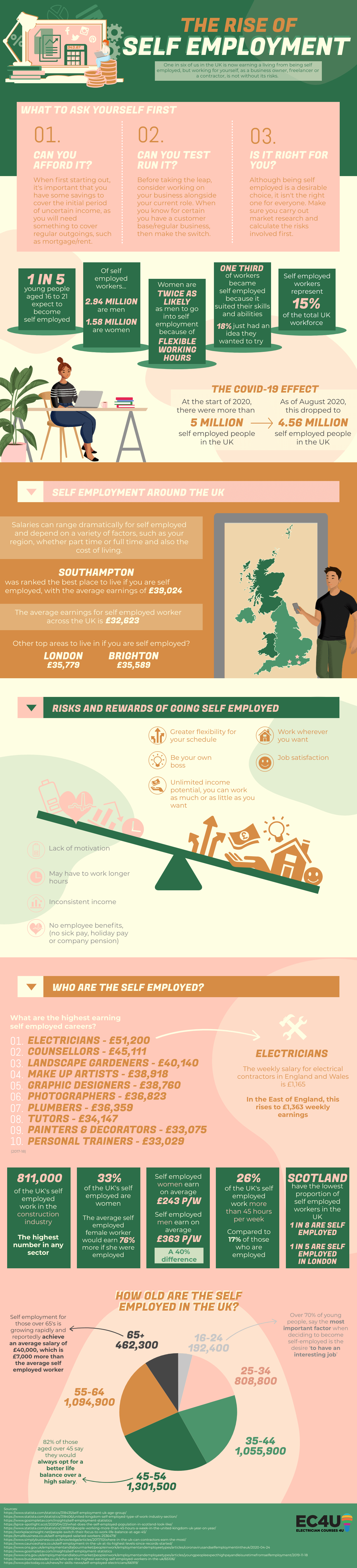

New figures show that the numbers of those in self employment, although high, they have decreased as a direct result of the COVID-19. At the start of 2020, there were a record setting 5 million self employed people in the UK. But as of August 2020, this dropped to 4.56 million people, detailing how self employed workers have been impacted.

Self employed people have many responsibilities when working for themselves, including: finding their own work, managing their own business accounts and paying taxes on time. However, in return, you will also become your own boss, get the opportunity to create your own career path, without relying on anyone else, and have unlimited earning potential.

There is a distinct entrepreneurial spirit with those working for themselves. Although you may think of self employed workers as young individuals who are breaking away from the city life and carving their own career paths, the average age of a self employed worker is actually 47.

58% of self employed workers are aged 45 or over, proving that there really is no age limit on starting your own business. 82% of those aged over 45 say they would always choose a better life balance over a high salary, and it shows, as the largest self employed age group is those who are 45-54, with more than 1,301,500 people. The reason for a rising number of over 45’s choosing self employment could be due to the difficulty of changing jobs at a later age, unexpected redundancy or staying productive with a business after retirement.

Over the past five years, the number of self employed over 65 year old’s has risen to more than 462,300 and shows no sign of slowing down.

Technology has been influential in driving up self employment numbers. A staggering 70% of all new businesses start off at home, helped by new technology devices which enable you to work from anywhere. Currently more than half of all businesses are home based, which is a benefit to self employed workers as it drives down building rental costs and further bills.

Business Opportunities

London is home to the most self employed people, with 1 in 5 people being self employed, compared to Scotland where 1 in 8 are self employed, the lowest proportion of self employed workers in the UK.

The most common self employment roles tend to be gig economy, for example, taxi driving and working in construction, due to the constant demand. Across the UK, there are more than 811,000 self employed people working in the construction industry, the largest amount in any sector.

Those working in the trade industry are more likely to be self employed and working for themselves, due to the nature of work. The top three self employed trades in the UK are plumbers, electricians and builders. Other high earning self employed career include: graphic designers, photographers and personal trainers.

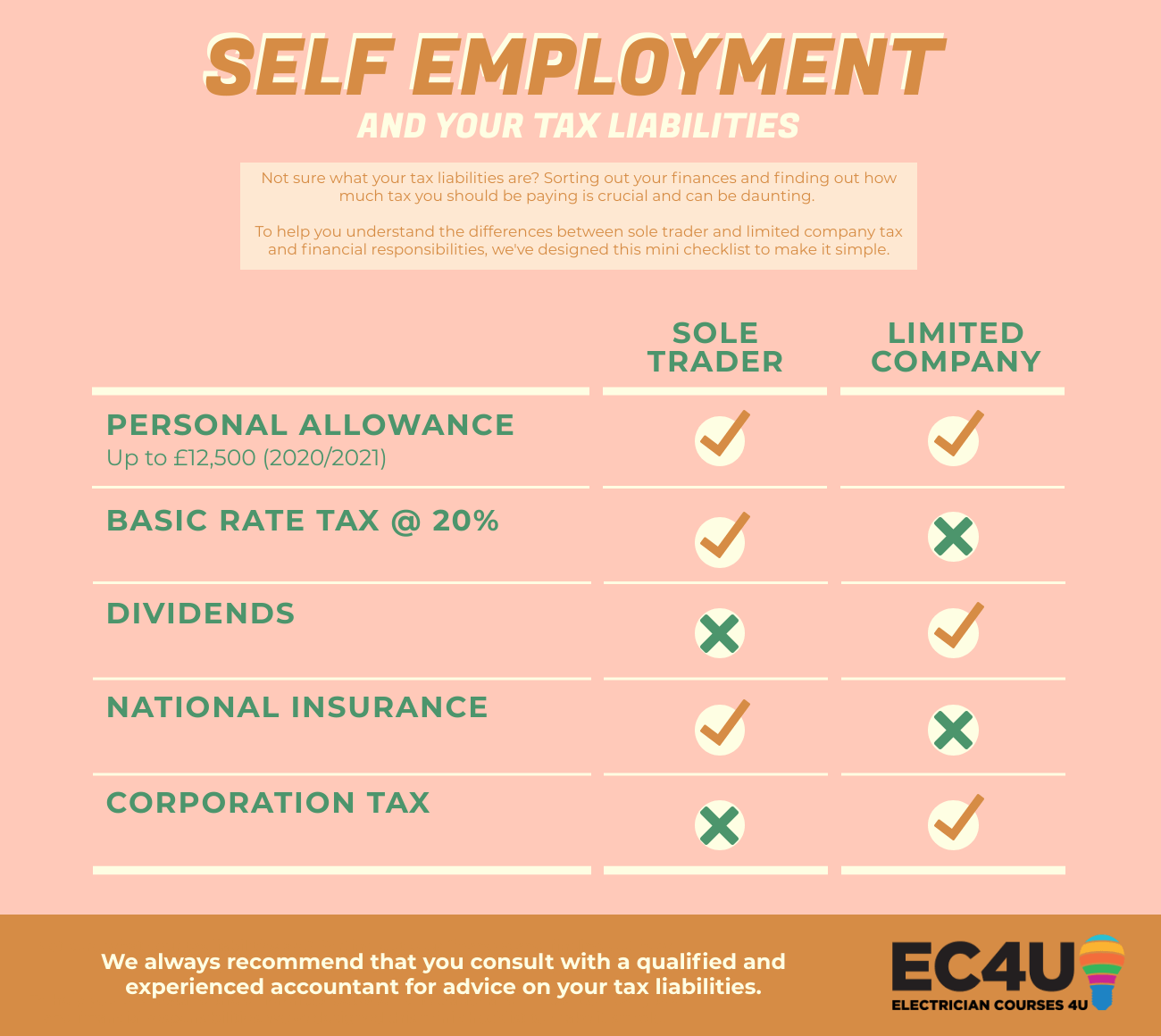

To share our ‘Sole Trader vs Limited Company’ infographic on your website, simply copy and paste the embed code below:

Sole Trader vs Limited Company

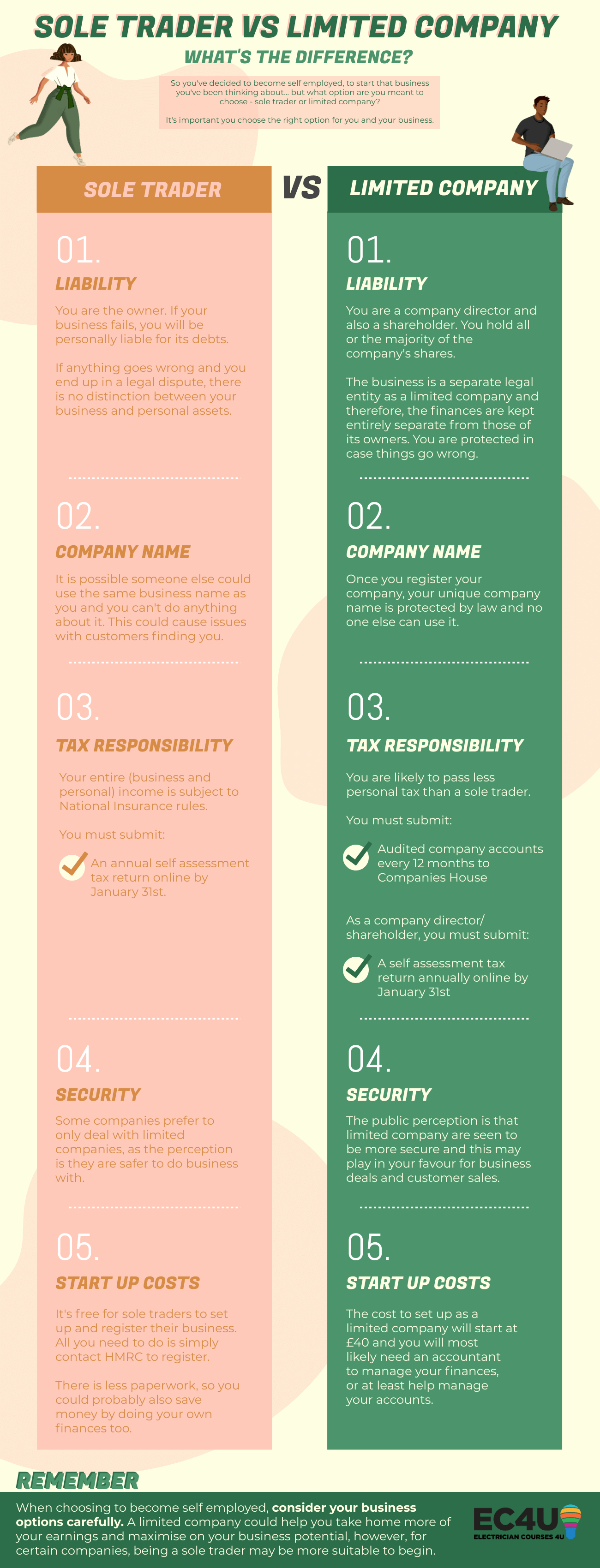

When choosing to become self employed, you have two main options for your business: become a sole trader, which is considered to be the simplest and cheapest of ways to start a business, or become a limited company, which gives your business a unique and separate identity but involves more administrative work to set up.

As of 2019, there are more than 3.5 million sole traders in the UK, which account for 59% of all businesses, and 2 million actively trading companies (34%). It is by far the most popular option for the self employed, being easy to set up and maintain. With sole traders, there is one individual who solely owns and runs the business 100%.

As a sole trader your business lacks the protection that a limited company has. If your business goes into to debt or a claim is made against your company, you are personally liable for this debt and risk bankruptcy, if the debt is considerably high. This is because there is no distinction between your business and personal assets when you are a sole trader.

When naming your company, it’s important to remember that there could be other companies out there with the same name, which could lead to confusion when a customer is trying to search for you online.

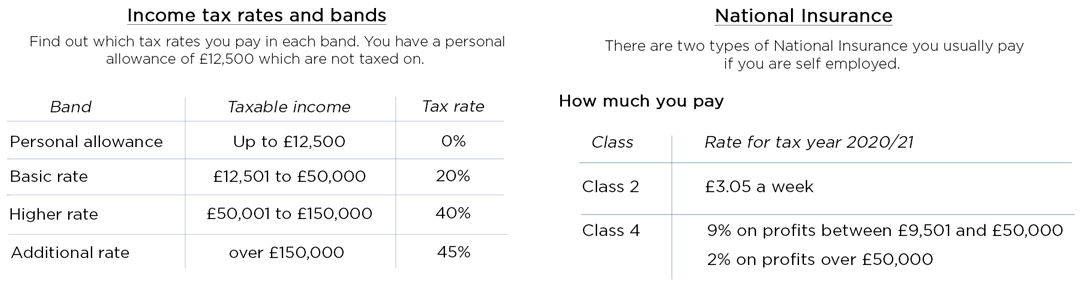

Remember to keep accurate records of your incomings and outgoings, as you will have to fill in a self assessment tax return online by 31st January every year, for the previous tax year. After submitting your tax return, HMRC will then send you a tax bill that will need to be settled with them directly. You will be liable to pay National Insurance on your taxable earnings, which you will asked to pay alongside your tax bill.

Please refer to the charts below, which shows you the current Tax bands and National Insurance rates for 2020/21.

There are currently 1.9 million limited companies in the UK, a number that is steadily rising. Limited companies offer the self employed the opportunity to build a unique company and identity, which is kept separate from the owner.

With limited companies, you will have more protection compared to a sole trader. For example, if the limited company is in debt, the debt is not on the hands of the owner, but solely on the company and you will not be liable personally.

The cost to set up a limited company can start from £40, which can include privacy of your personal address details if required. Some companies will prefer to deal with only limited companies, as the public perceive they are safer to do business with.

As a small business and limited company, the director is subject to tax under the current PAYE Government scheme. Usually, a company director will be paid slightly below the minimum tax allowance (£12,500) which attracts 0% tax.

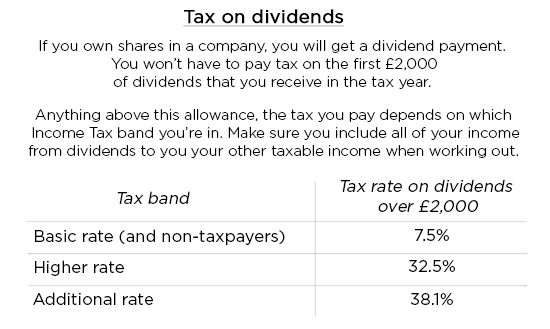

When setting up the company, you will also be named as a shareholder of the business, as with every limited company, which will top your pay up accordingly by paying yourself dividends.

Dividends are an additional salary which can only be paid if your company is making a profit. Please refer to the chart below to see how dividends work and could apply to your business.

If you are named as the company director and a shareholder who has received dividends, you will also have to file a personal tax return online by 31st January, just as a sole trader would. They will then calculate how much tax you owe and send you a tax bill for you to settle.

At the end of each financial year, you will have to submit audited accounts to Companies House, which is done by your accountant. Your accountant will also calculate from any profits your Corporation Tax due to HMRC.

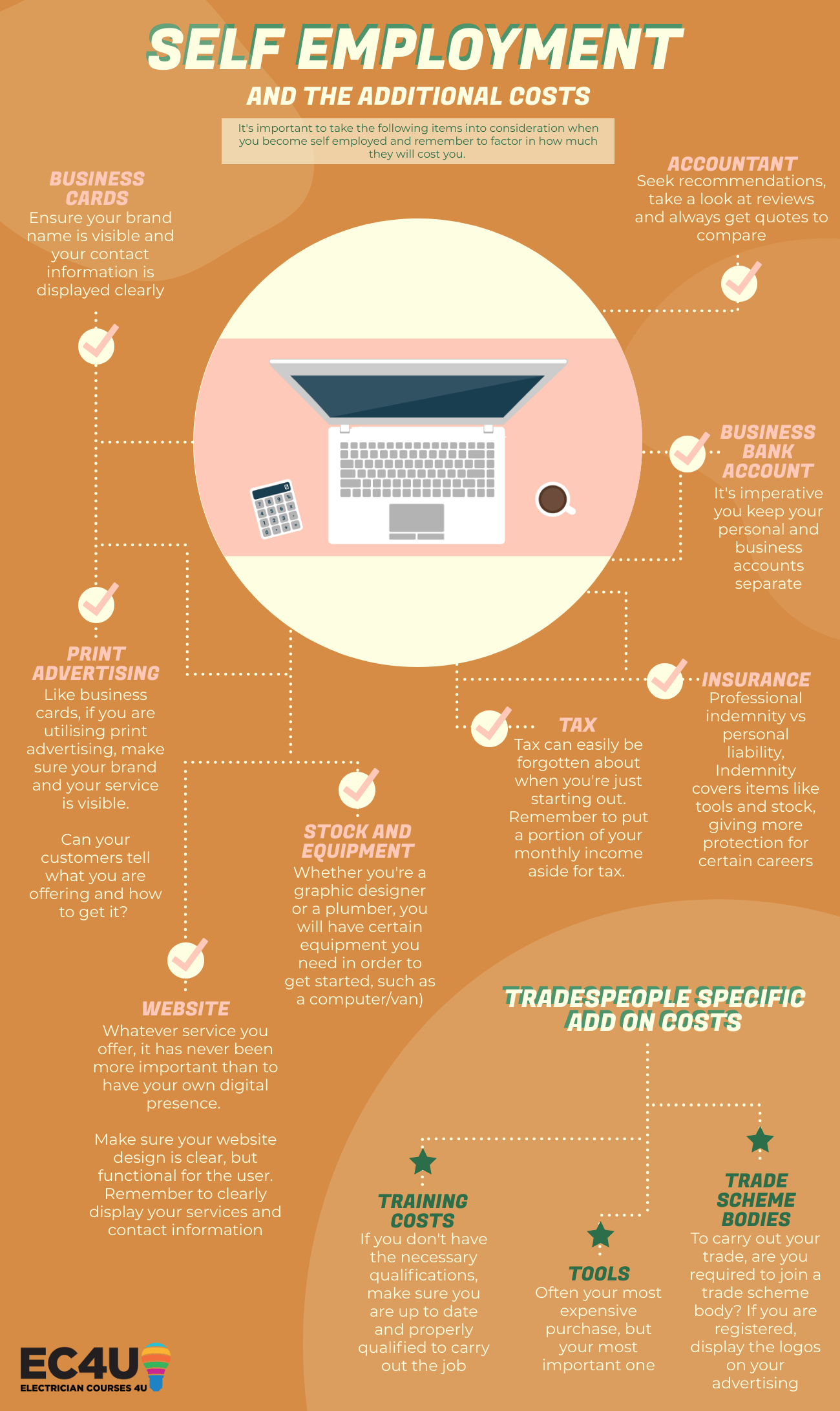

Additional costs to consider

After you have chosen to become either a limited company or sole trader, you then need to take the following important items into consideration and factor in how much they will cost you additionally.

Professional Indemnity & Personal Liability Insurance

No matter what your business is, you must take out insurance. The type of insurance you take out for your business depends on the type, most commonly either professional indemnity or personal liability. Research both options carefully and decide which one is best for your business.

Business Bank Accounts

Look out for great deals on business bank accounts, as it’s crucial for you to keep your business and personal bank accounts separate. Banks often have deals that include a certain number of years free on business accounts, with no additional banking costs associated with it. Try using MoneySupermarket to find the best offer in the market currently.

You should also research accountancy firms for your business. It’s helpful to get recommendations and also get various quotes to compare, to find the best price and service.

Business Cards

You want to leave a great lasting impression on your customers, suppliers and business relations, and the best way to do that is with a good quality business card that represents your business well. Consider other stationary such as headed paper, especially if you are issuing estimates and quotes, and also any marketing or advertising to get your name out there.

Website

If you haven’t already, make sure your business has a professional website. It is often the first impression anyone has of your business, especially potential customers. In the digital age, everyone needs to have an online presence to tap into new markets and it also makes it easier for customers to find you. Make sure your company website is responsive and engaging for the user, and that you have your contact information listed clearly.

Other Important Considerations

If you require a car or van for your business, consider the various costs that come with running a vehicle (price, fuel, insurance, repairs, etc). Decide which is better for your business, car or van, and also consider having your business logo displayed on a van, including your contact information.

If you are joining the trade industry, three main costs you will need to consider are: government professional bodies, training requirements and tools.

If you plan to join any government approved professional bodies, remember there are annual fees for each. There are various bodies for different trades. For example, for electricians, there is NICEIC for registered electricians and for plumbers and those working with gas, there is Gas Safe. Make sure you find the right scheme body to join.

If you require training in your chosen field, it’s important to remember the costs that come with retraining or expanding on your qualifications and skills.

If you are going self employed in the trade industry, tools for the job are essential and can also be costly. Make sure you cost out essential tools you will need on the job and then branch out for more tools later on as your business expands. Make sure you research different brands, go to tool suppliers, make sure the grip is comfortable and suit your needs. For example, if you work in small spaces, you will not want big, clunky tools to use, you will want to go for smaller, compact tools that perform well in tight spaces.

Summary

Remember to consider your business options carefully, whether you opt to become a sole trader or a limited company. They both have their benefits, but one may be better suited for you than the other.

A limited company could help you take home more of your earnings and also maximise on business, as it gives you a unique identity, security and better potential for growth.

With either business options, it’s imperative that you make sure all of your accounts are accurate from the start. A clean start will enable you to keep better track of tax and VAT returns when the time comes. It is easier to run your business when everything has been organised and well maintained. It is not uncommon for you to pass your accounts on for an accountant to complete, allowing you more time run your business.

But above all, now that you are self employed, you have the freedom to create a work schedule that works around you and your needs. Now’s the time to embrace that entrepreneurial spirit and build your business from scratch, while making money from doing something you enjoy and are passionate about.

If you enjoyed reading about becoming self employed, then take a look at our guide to getting started as an electrician!